What Is A Perfect Credit Score ?

If you want to learn what is a perfect credit score, you should definitely read this article. We will be discussing what factors influence the calculation of the FICO score, and why it is important to know them if you wish to achieve that high credit rating. After reading this article, you should have an idea of what it takes to get the best possible credit score.

There are many websites and publications that claim to provide answers to the question “what is a perfect credit score?” Unfortunately, these claims are usually false. People often see advertisements for programs that promise to show people how they can obtain a perfect credit rating. The reality is that such programs can be quite expensive.

Why does a lender consider your credit history when determining the interest rate or the credit limit of a loan? The main reason why lenders make use of your credit score is so that they will be able to estimate the possibility of repayment. That is, if you have a perfect credit score, they will know that you will pay your debts on time. If, on the other hand, your credit history is less than perfect, they will be more inclined to extend credit to you. They calculate the risk involved in lending you money based on your credit history.

Your credit score is determined by the three major credit reporting agencies. These agencies are TransUnion, Experian, and Equifax. These agencies collect and store information about your financial activities, including the loans you have taken and the payments you have made. They then publish these details in their credit report, each of which is assigned a score. Credit scores are used by lenders, such as credit card companies and mortgage lenders, when evaluating your financial responsibility.

Why Is my Credit Score Important?

Your credit rating may affect your ability to get low interest rates on the credit you need. It may also affect whether or not the apartment you want to rent is owned by a lending institution, or rather owned by the landlord. Similarly, it can determine whether or not you are qualified for employment, or even whether you are eligible for a credit card.

So, how do you improve my credit score? One way is to pay your debts on time. Most consumers who have a decent credit history do not require a lot of upkeep on their accounts. If a lender observes that you are a regular borrower and that you make all your payments on time, they are more likely to offer you a loan. You can improve your credit score by being a responsible borrower.

Another way is to get a copy of your credit report. When you receive a copy of your credit report, examine it closely for errors. Any errors should be addressed in writing to the reporting agency and the error should be corrected. By checking your credit rating on a regular basis, you can catch errors before they cause you significant damage.

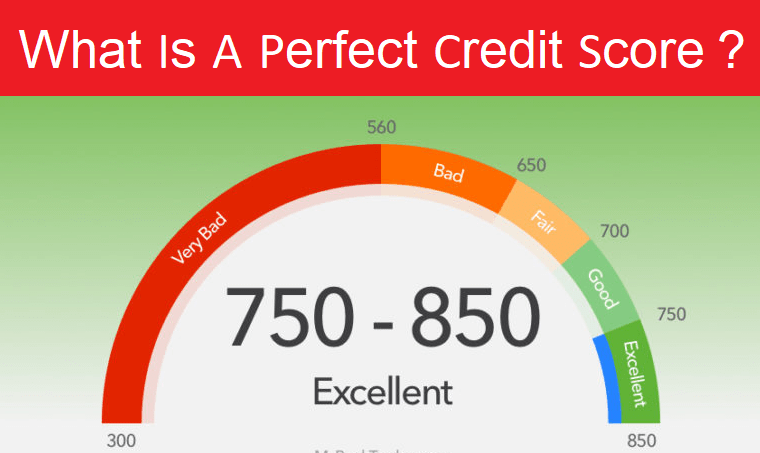

What Is A Perfect Credit Score?

It depends. Some people may find that they have a high credit score, while others may find that their credit is terrible. If you think you have a bad credit rating, it is important to dispute any negative information with the credit bureau. This process can take some time but is well worth it in the long run. Ultimately, you want to have a good credit rating so that you can do what you want when you want.

Your credit rating will give potential lenders an overall impression of your responsibility. If you pay your bills on time and for the amount owed, this will help to increase your credit score. Unfortunately, some people find that their credit rating does not improve because they made no efforts to improve it. This is really where monitoring your credit closely can make the biggest difference. With so many credit cards and loans available, many people are unaware of their actual credit scores.

What is a perfect credit score? It depends. Some people may have a high credit score but may be paying off too much debt. If you do not pay enough attention to your credit rating, you may find that it is actually lower than you thought.

What is a perfect credit score? It depends. Some people may have a high credit score, but may be paying more than they need to. When you begin to monitor your credit closely, you can determine just how your credit is performing. If you do not pay enough attention to your credit, you might discover that your credit score is lower than you thought.

You can click on this link for everything you wonder about Credit Card Limit Increase.